Protection

We're committed to nurturing your growth with a dynamic protection strategy. Our tailored approach shields your investments from volatility and fosters sustainable growth, ensuring your financial future flourishes with confidence and prosperity.

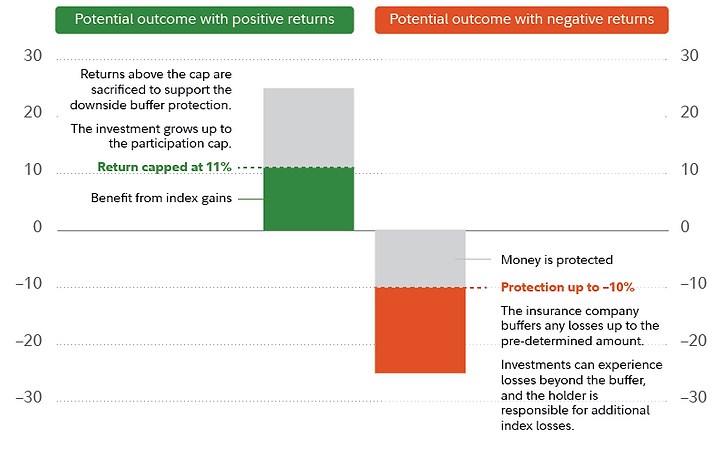

Many people are unaware they are able to get much of the upside of investing in the stock market but don't have to take on all of the risk and sometimes none at all.

This may sound very expensive, but in reality much of it can be done at zero explicit cost. By putting an upper limit on the maximum gains we can also limit the downside.

Success is not defined by capturing every bit of gain, it is defined by limiting volatility and providing returns that match the investor goals providing the desired lifestyle and outcome.

1

Buffers

A buffer is a layer of protection that exempts your portfolio from some downside loss during a specified time frame. For example, if you have a 20% buffer over 1 year on the S&P 500. The S&P 500 would need to fall 21% before you were down 1%. The first 20% of downside is wiped away at the 1 year mark. Often in return for the protection you must also have a maximum upsides (cap), but in some cases you may get the full upside without limitation.

It is well know that index investing the a tried and true way to grow assets over the long run, but it is also quite volatile which makes some investors uneasy. By using a buffer to reduce downside risk, investors can more calmly navigate the financial markets and make decisions without fear of imminent loss.

_Edited%20File.png)

2 Principal Protection

Elite Wealth Solutions offers principal protected index investments, providing investors with a unique opportunity to achieve returns without risking their initial investment. With our innovative approach, investors can capitalize on annual market returns while enjoying the peace of mind that comes with knowing their capital is protected.

Our investment strategy ensures that if the market experiences growth, investors earn profits. However, in the event of a market downturn, investors incur no losses. This means that regardless of market fluctuations, investors can maintain their financial stability and safeguard their wealth.

At Elite Wealth Solutions, we prioritize the security and financial well-being of our clients. With our principal protected index investments, investors can confidently pursue their financial goals, knowing that their investments are shielded from market volatility.

3 DefineD Outcome

Defined Outcome Investments, offered by Elite Wealth Solutions, present a unique opportunity for investors seeking both growth potential and downside protection. With our innovative approach, investors can participate in market returns while knowing the exact range of potential outcomes for their investment.

Our Defined Outcome Investments ensure that investors have a predefined range within which their investment will perform. This means that regardless of market fluctuations, investors are shielded from extreme losses. In the event of market growth, investors can benefit from upside potential, while also having a clear understanding of the maximum and minimum returns they can expect.

At Elite Wealth Solutions, we prioritize transparency and risk management. Our Defined Outcome Investments empower investors with the confidence to pursue their financial objectives, knowing that their investments offer a structured approach to both growth and protection. With defined outcomes in place, investors can navigate market volatility with greater certainty and peace of mind.